Managing money is an essential skill in today’s fast-paced world, yet many individuals fall victim to various money traps that hinder their financial stability.

These traps may seem enticing or even unavoidable at times, but with proper awareness and a proactive approach, they can be avoided altogether. In this blog post, we will discuss some common money traps and provide practical advice on how to steer clear of them.

Understanding these pitfalls and learning how to avoid them is essential in your quest for a stable and prosperous financial future. So, let’s embark on this exploration of financial hazards and the strategies to sidestep them, ensuring that your financial goals remain firmly within reach.

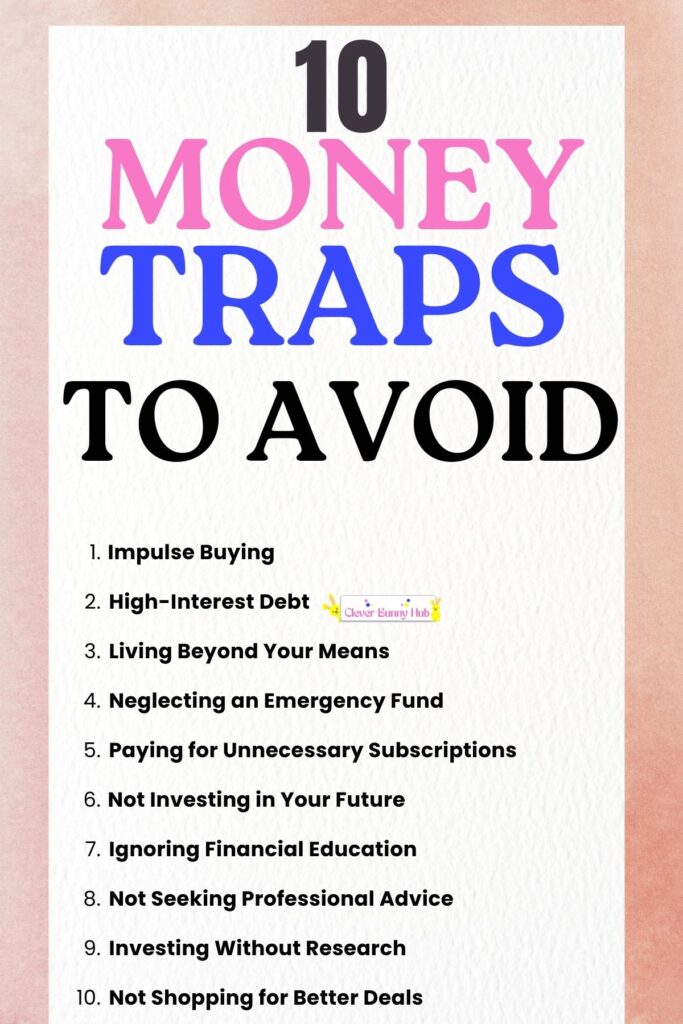

10 most common money traps to avoid

1. Impulse Buying

The desire for immediate satisfaction can lead to impulsive buying decisions, often resulting in unnecessary expenses and a drain on your finances. Avoid this trap by adopting a more disciplined approach to spending.

Consider implementing the 24-hour rule, which involves waiting for a day before making any major purchases. This period allows you to assess whether the purchase is truly essential or just an impulse.

Impulse buying is a money trap that can quickly derail your financial goals. To avoid it, practice mindful spending by creating shopping lists, waiting before making non-essential purchases, and distinguishing between needs and wants.

2. High-Interest Debt

Credit cards and personal loans can be lifesavers in times of need, but they can also turn into money pits. High-interest debt accumulation makes saving and investing more difficult and increases financial stress. Focus on using credit cards wisely and pay off bills in full each month to avoid high-interest rates. Pay off existing debts as a priority.

Your finances may suffer if you carry high-interest debt, such as credit card bills. The interest you spend on these debts can add up rapidly and make it difficult for you to invest and save money. Put paying off high-interest debt at the top of your list to free up more money for your financial objectives.

3. Living Beyond Your Means

The desire to raise your level of living as your income increases is understandable. Living beyond your means is one of the most prevalent financial pitfalls. It’s simple to fall victim to lifestyle inflation, in which your spending rises along with your income.

As a result, it may become difficult to invest in the future or save money. Create a budget and stick to it regardless of income fluctuations to prevent falling into this trap.

Society often glorifies material possessions and equates them with success. Falling into the trap of overspending to maintain appearances can lead to a cycle of debt and financial instability. Remember, true wealth lies in financial security and peace of mind, not in flashy gadgets or designer labels. Embrace a more minimalist lifestyle and prioritize experiences over possessions.

4. Neglecting An Emergency Fund

Life is unpredictable, therefore unplanned expenses could happen at any time. When you don’t build up an emergency reserve, you are more vulnerable to financial catastrophes.

Put saving money in an easy-to-access account for three to six months’ worth of expenses as a top priority. People will have the cushion they need in the event of unanticipated circumstances or job loss thanks to this fund, which acts as a safety net.

If you don’t build an emergency fund, you may be certain that your financial goals will be derailed. Life is unpredictable, therefore unplanned expenses could happen at any time. Try to save away three to six months’ worth of living expenses in a dedicated savings account to protect yourself from financial emergencies.

5. Paying For Unnecessary Subscriptions

Subscriptions have become a normal aspect of our lives in the current digital era. However, it’s easy to accumulate multiple subscriptions that go unused or provide little value.

Regularly evaluate your subscriptions and cancel those that are not essential or no longer align with your goals. This practice will help you regain control over your finances and redirect those funds towards more meaningful purposes.

Subscriptions can hinder our financial goals. Whether it’s saving for a down payment on a house, paying off debt, or investing in our future, every dollar counts.

When we allow ourselves to become entangled in a web of subscriptions, we divert funds away from these important goals. It’s essential to prioritize our financial well-being by identifying which subscriptions truly add value to our lives and which can be eliminated.

Related Posts

None found

6. Not Investing In Your Future

Many people assume that saving money will be sufficient on its own and neglect to invest for their future. However, as money loses value due to inflation over time, it is crucial to invest in things like stocks, bonds, or real estate that have the potential to increase your wealth.

When we choose not to invest in our future, we miss out on the potential growth and financial security that can come from making smart investments. Whether it’s investing in stocks, real estate, or even in our education and skills, these investments can yield substantial returns over time. By avoiding investing, we limit our ability to grow our wealth, leaving ourselves vulnerable to financial hardships and missed opportunities.

7. Ignoring Financial Education

Poor financial decisions may result from a lack of financial education. To make decisions that are in line with your goals, invest the time necessary to educate yourself on personal finance, budgeting, investing, and other pertinent issues.

Those who lack financial understanding may find investing scary, which frequently results in mistrust or missed opportunities. But in order to increase our wealth and ensure a stable financial future, it is essential to understand the fundamentals of investment.

We can make wise choices to amass money over time by learning how to evaluate investment possibilities, diversify portfolios, and manage risks efficiently. We may have fewer options if we ignore financial education, which could also make us more susceptible to future financial problems.

8. Not Seeking Professional Advice

Sometimes, financial matters can become complex, and making the right decisions may require professional guidance. Don’t hesitate to consult with financial advisors or experts when facing major financial decisions or challenges.

When it comes to managing money, financial advisors have particular knowledge and expertise. They are skilled specialists who regularly stay current on market trends, investment tactics, and tax laws.

Making decisions based only on your personal experience or online research could leave you unprepared. By asking a professional for advice, you may take advantage of their knowledge, improve your financial planning, and ultimately stay out of expensive money traps.

9. Investing Without Research

Blindly investing without understanding can result in losses. Conducting research not only provides valuable insights into investment opportunities but also enhances an individual’s investment knowledge and decision-making skills.

The more investors engage in thorough research, the better they become at analyzing and evaluating potential investments. This continuous learning process enables investors to make sounder judgments, increasing the likelihood of successful investments over time.

10. Not Shopping For Better Deals

Failing to compare prices and shop for discounts can cost you. Avoiding shopping for better deals can be a significant money trap that holds us back from saving and achieving our financial goals. By falling into the habit of accepting whatever price is presented to us, we miss out on opportunities to save money, find better products, and gain financial flexibility.

Actively seeking out better deals broadens our perspective and empowers us to make informed decisions that align with our needs and aspirations. Remember, a little effort to explore alternatives can go a long way in securing financial well-being.

Conclusion

Avoiding money traps requires a conscious effort to prioritize financial stability and make smart choices in our daily lives. Incorporate these five practices into your financial strategy to ensure a secure and prosperous future.

By resisting instant gratification, managing debt responsibly, living within your means, building an emergency fund, and reassessing subscriptions regularly, you will pave the way for a healthy and financially fulfilling life. Remember, small steps in the right direction can lead to significant financial progress over time.